Innovation out of Tradition

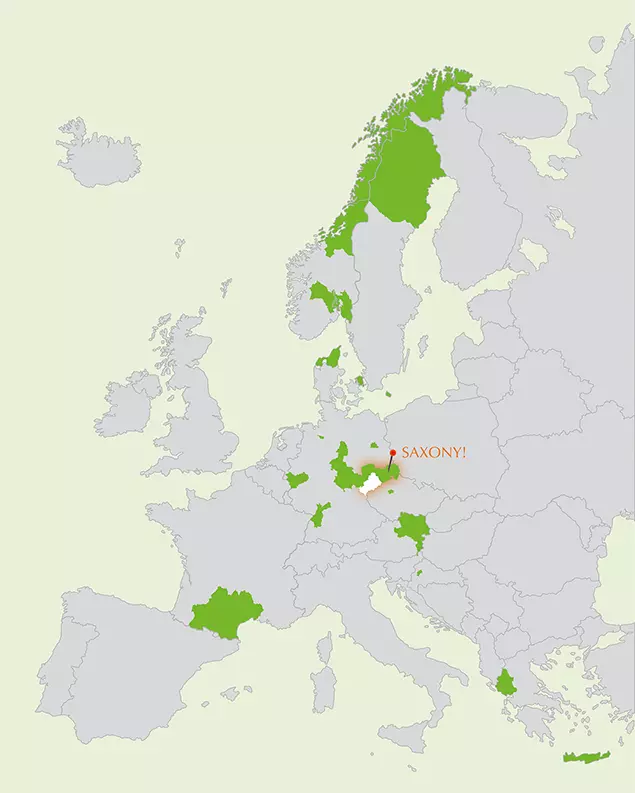

Saxony's great innovative strength was and is a major asset. This is confirmed by the EU "Regional Innovation Scoreboard": Saxony is a European "Strong Innovator".

Infomodul

EU "Regional Innovation Scoreboard" - Saxony Scores With:

-

R&D expenditures

high public and corporate spending on research and development -

Innovative SMEs

High expenditures on innovation in the SME sector -

Process innovations

above-average number of SMEs introducing process innovations -

High-tech Workplaces

Large number of employees in innovative SMEs

Strong Focus on Research & Development

R&D expenditure in the public and corporate sectors is one of the most important drivers of growth in a knowledge-based economy. Research intensity (R&D expenditure as a proportion of a region's GDP) is therefore an important indicator of a region's future competitiveness and prosperity.

The region around Saxony's state capital of Dresden in particular has ranked among the top 5 regions in the EU for years (2025: rank 1). The Leipzig region is also consistently among the top 10.

Contact

Dr. Uwe Lienig

Industry, Innovation & Marketing

+49-351-2138 201